TCS on Purchase and sales

By Administrator on April 8, 2021

BeginnerTCS Rule

The provisions of sub-section (1H) of section 206C has been made effective from 1st October 2020 and state that:

- A Seller of Goods is liable to collect TCS from Buyer on Sale of any goods;

- Turnover of seller is more than ₹ 10 Crores in preceding financial year;

- TCS to be collected if the Value/Aggregate Value received for Goods from a buyer is more than ₹ 50 Lakhs in a financial year;

- TCS to be collected on [ Total Sale Value received – ₹ 50 Lakhs];

- Rate of TCS is 0.1% , if PAN of buyer is available [ 1% if PAN not Available ].

Setup in ERPNEXT

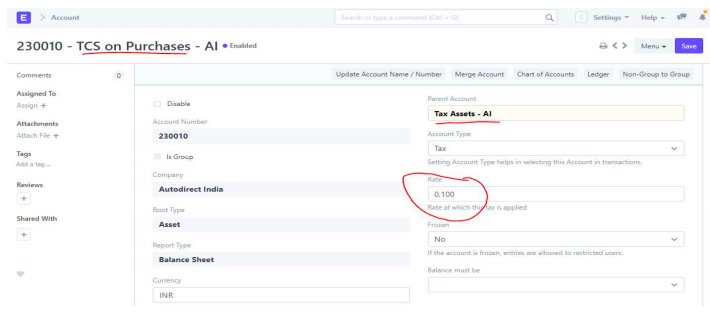

- Create New GL for TCS under Account type ”Tax” and Rate 0.1%

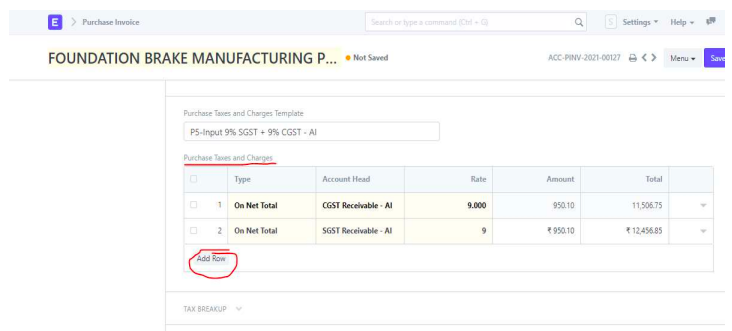

On Purchases Invoice Under “Purchases Taxes & Charges” filed Click on Add Row

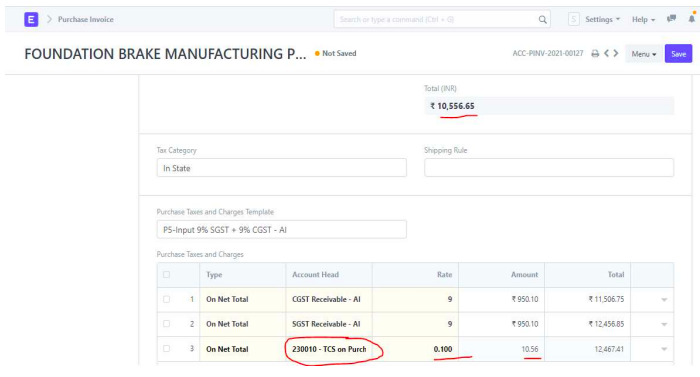

In Account Head Filed add TCS on Purchases GL ( Which We create Earlier)

Check the Auto Calculation then Save & Submit Document

………..End of Document ………….

Was this article helpful?

More articles on ERP Documents